Table of Content

More so because in spite of the abundance of home loan solutions, the cost of capital becomes an important factor is proposing a project. Truly global in its standing, HSBC has a strong Indian connection going back to 1853 with the origin of Mercantile Bank in Mumbai. Within a short period the bank has spread it wings offshore with a strong presence in South East Asia and China. HSBC too has its roots in China since its founding, took over Mercantile Bank in 1959, thus establishing a firm foothold in India. This is the initial percentage rate at which we calculate the interest on the mortgage.

The floating interest rates are linked to the bank’s Repo Linked Lending Rate . You can avail a maximum tenure ranging from 20 to 25 years. The maximum loan amount that can be availed is Rs.30 crore.

HSBC Bank Home Loan EMI Calculator

HSBC offers are generous in the case of its Premier customers. The maximum amount allowed in all the sourcing cities of India the cap is at Rs.10C. The rate of interest and any up front charge impacts the overall outgo in repayment of the loan and the size of the EMI.

We know that when it comes to choosing a mortgage, there's a lot of jargon to get your head around. In this example, the overall cost for comparison is 6.50% APRC representative. © The Hongkong and Shanghai Banking Corporation Limited, India . HSBC reserves its absolute right to withdraw or alter any of the terms and conditions at any time without prior intimation.

Offers

All decisions with respect to the loan shall be at the sole discretion of HSBC and the same shall be final, binding and non-contestable. Other than the specific entitlements available to the customers under this offer, any other claims with regard to this offer against HSBC are waived. Please be advised that applicable Indirect Taxes would be recovered on all our fees and charges and any other amount liable to tax under prevailing Indirect Tax Laws.

Information is for the reference of existing MyHome customers only. Interest rate is current as at 19 December 2022 and is subject to change. ~ Promotional offer available on new borrowings from $50,000.

Features & Benefits of HSBC Home Loan

NRIs will be granted loans as long as they have a local co-applicant.

The fee will be levied only on the overpaid amount which exceeds the 25%. We offer award-winning home loans no matter if you're looking for a balance transfer, or to invest in the UAE as a resident already, or not. At HSBC Bank, there is no prepayment charge on home loans so you can close your loan without paying any fee.

How a Fixed Rate Home Loan works

A complimentary Mastercard Credit Card loaded with unique offers like lounge access at airports, shopping offers etc. However, home ownership and purchase of immovable property by the NRI is governed by the guidelines framed by the RBI and the regulations of FERA. They are entitled to own immovable property which are residential or commercial, while farm land and plantation is barred. HSBC provides the NRIs with ample scope of home ownership through their home loan schemes, which are not dissimilar to the ones extended to the residents in character or features. In fact they enjoy all the facilities similar to that of the resident, as far as the home loan goes. Once the rate of interest has been studied, the following step would obviously be the eligibility criteria applicable to the prospective borrower.

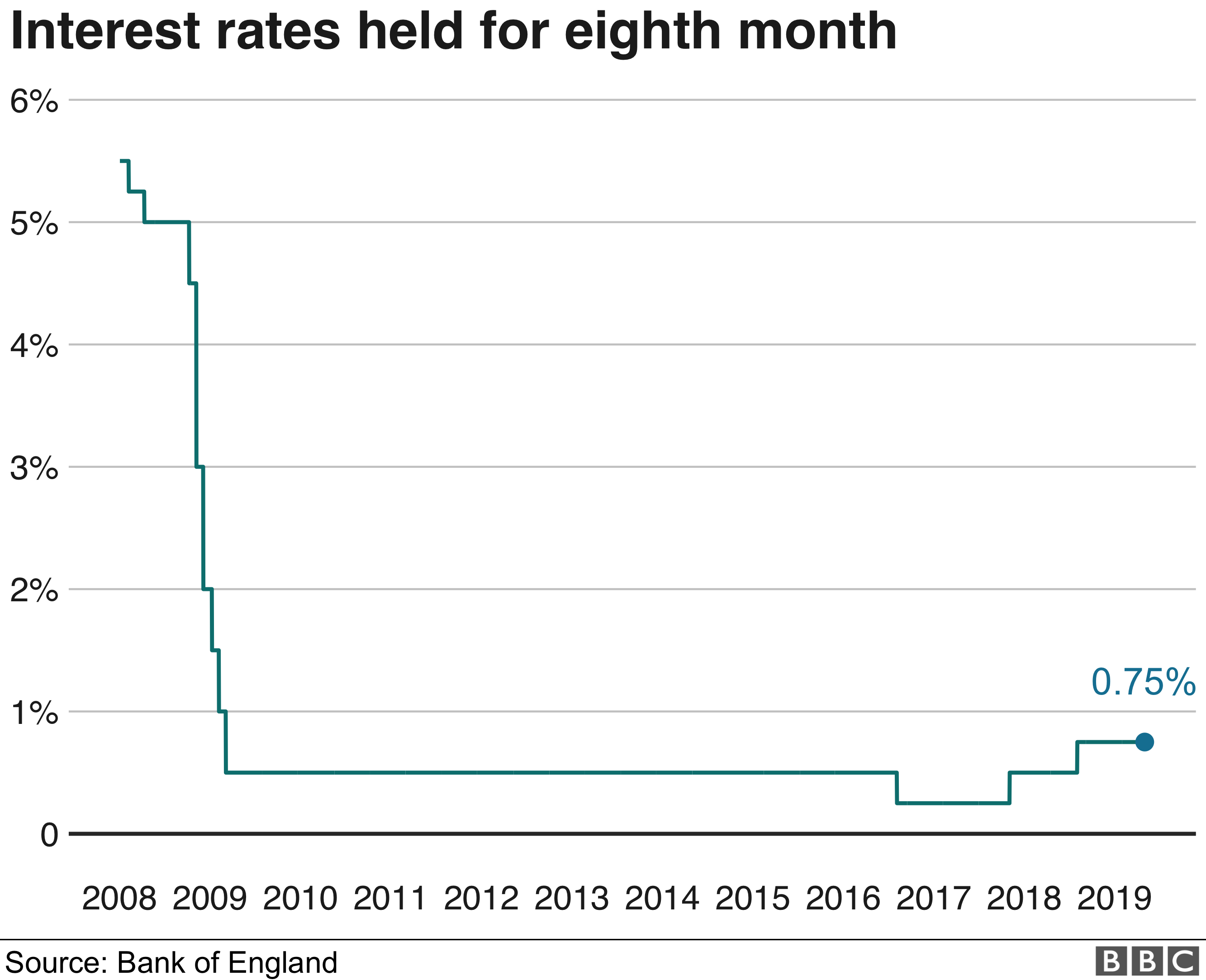

For amount in excess of 25% of the outstanding loan amount or more than one prepayment 4% of Pre-payment amount. Penal interest on the delayed instalments on account of cheque or SI 2% over and above the existing interest rate charged on the loan account for the amount which is overdue. Penal Interest on the delayed installments on account of cheque or SI 2% over and above the existing interest rate charged on the loan account for the amount which is overdue. However, further interest rate hikes up to a maximum of 250 basis points “would burden households’ repayment capabilities”. The CBM study shows that the household loan situation will remain healthy up to an interest rate shock of 150 basis points.

This is calculated annually on the date your fixed-rate period started. You can make additional payments during the fixed-rate period without incurring an early repayment charge . Anything over the 10% will incur an ERC, which is a charge you may have to pay if you repay the whole or part of your mortgage early. This includes if you move to a different HSBC mortgage rate, or move to a different lender during your fixed period. Mortgage and home equity products are offered in the U.S. by HSBC Bank USA, N.A. Discounts can be cancelled or are subject to change at any time and cannot be combined with any other offer or discount.

Household debt stood at around 24% of financial assets and 87% of disposable income by June 2022. These indicators remained largely in line with their average since June 2009. The study analysed new loans issued between the fourth quarter of 2020 and the second quarter of this year, and subjected them to interest rate hikes of up to 250 basis points. The data comes from a Central Bank of Malta study that analysed the impact of higher interest rates on borrowing costs for households.

The increase in interest rates should translate into higher borrowing costs for households and companies, which would in turn affect consumer spending, with the aim to help cool inflation. But a rise in borrowing costs could also impact the debt repayment capabilities for existing borrowers, which could translate into higher credit risk on banks’ balance sheets. The above representative example is based on the highest APRC applicable to customers purchasing a property. Please note your actual costs and monthly repayments will vary. Loan applicants should have a basic idea of what their EMIs would look like. This will help applicants better plan their finances and also decide on what repayment tenures work for them.

All the eligibility norms in them being same, the rates of interest applied to them vary. The charge is recovered in two installments of Rs.5000 + GST each at the time of application and disbursal respectively. HSBC is one of the important lenders in retail lending with home loan product suitable to the prospective Indian borrower.

No comments:

Post a Comment